Are your financials guiding you in day-to-day decisions to manage, lead and grow your business?

Part 1

As a business owner, I am sure you are familiar with financial statements such as a profit and loss, a balance sheet, and maybe even a statement of cash flows. They give you a summary of operational activities, assets (stuff you own), liabilities (stuff you owe), and coming and going of cash.

With a good bookkeeper, you may get monthly financials 25 or 30 days after the close of the prior month. Your tax accountant may even play that role and produce monthly financial statements.

So, what are these financials doing for you and your business?

- You give them to your tax accountant so your taxes can be prepared

- Your banker might take them to satisfy loan covenants

- You could even review them

The question then becomes about action. As a small or medium business owner, you have the ability to be agile and to make decisions quickly and change your direction in very little time. Essentially, you can continue to drive growth and profitability quickly.

The quandary lies in the fact that much of your data does not move as fast as you and the business. This is not a function of a data problem. The data exists within your business. In fact, I would venture to guess there is more data available in your business than you can or will ever use.

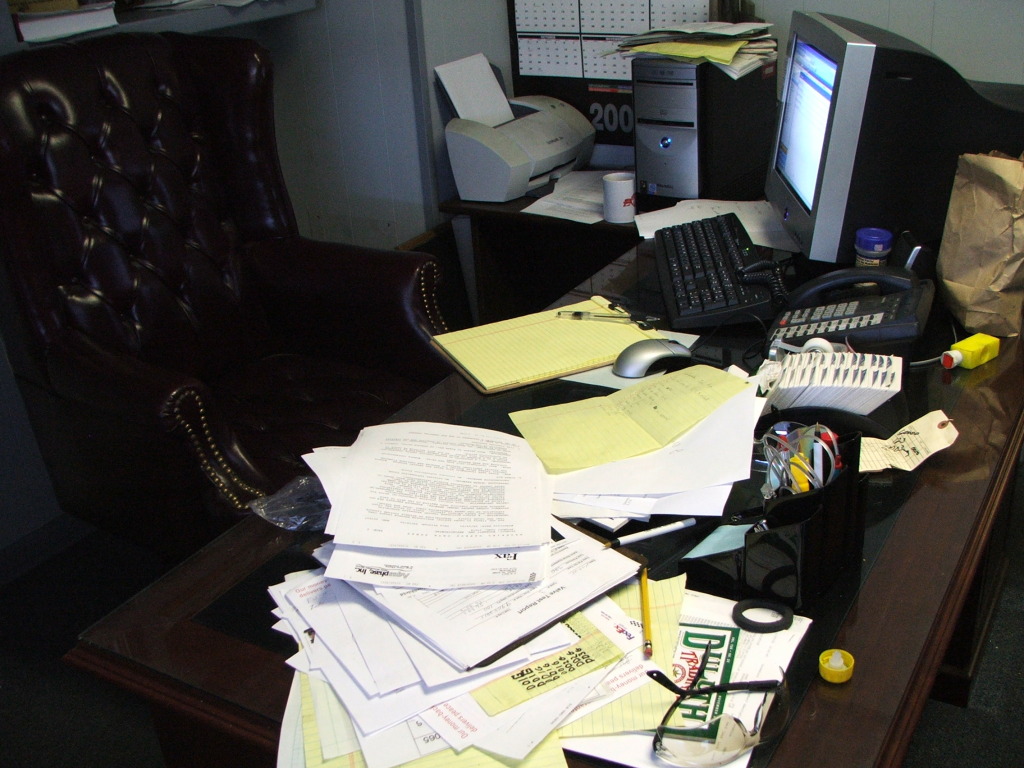

This issue is more likely related to outdated systems, processes, technology and habits. Here are some indicators of ineffective data use in your business:

- Paper is collected and moved around to people or service providers

- Your online bank balance is the only current and repeated metric you use to manage your business daily

- Your financial statements are 20 or more days after the close of each month

- None of the parties related to your accounting and finance functions are in the business more frequently than once per month, ever

- You are tax planning by making purchasing decisions at year-end based on where you think you ended

- Your key indicators for the condition of your business are in your head

- You are not measuring goals, progress, or results as they relate to finance and accounting

- You don’t have the ability to integrate non-financial data into your reporting metrics

- You don’t know what your gross and net margins are currently

- You don’t know what your margins should be in an ideal scenario

Don’t take any of these indicators as an offense, but rather allow yourself to identify with the portions you currently live with in your business. Be realistic about your challenges and shortcomings and allow them to drive the change you need in your organization.

In Part 2 we will look at how to make your accounting and finance matter in your business by becoming actionable.

Are you already seeing that your accounting and finance functions are not giving you the value and data you need to make decisions and lead your organization?

If you would like a free 30 minute consultation on updating your accounting and finance to become actionable give us a call at (623) 505-5945 or click HERE to leave your name and email and we will get in touch with you.

The team at Tikvah Group