Once again we are nearing year end. Does this time of year make you tense? Are you dreading your looming responsibilities?

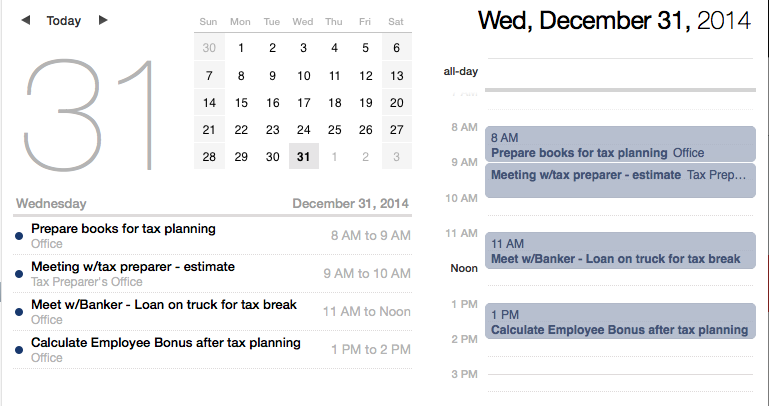

Traditionally this is the time tax planning would start with your preparer. You have ran your business all year most likely focusing on one or a few initiatives, honing your products or services. However, now there is mounting pressure on you as the business owner to get the financials put together as tightly as possible so you can get a reasonable tax estimate and determine if there is anything you should be doing to help reduce your potential year-end tax liabilities. This methodology has worked to some degree in the past, so it should continue to work.

Or has it? Has it really worked? Is it possible that small and medium businesses have followed the status quo and not really found proactive partnership in the finance of their business? Could this process be better? If your operations continue every month all year how can you not be starting January with some degree of this planning in your execution? Why isn’t it normal to have rolling forecasts for year-end projections continually helping to shape this process from the start all the way to the end?

Your finance and accounting partner should be working with tax planning matters from January through December every year. Transactions that affect your tax situations don’t only happen in December. This is strategic planning.